Oschadbank issued the first loan to a veteran under the Business 4.5.0 program

A veteran client of Oschadbank received the first loan under the special program to support veteran business, "Business 4.5.0". The loan was issued to replenish working capital in the amount of UAH 550 thousand for the purchase of fuel and lubricants, small car parts, and other business expenses. The loan term is 12 months. The compensation interest rate as of the date of the loan agreement is 13%.

The borrower is a former serviceman of the Armed Forces of Ukraine who served until mid-2023 and after demobilization due to injury returned to his business – cargo transportation in Ukraine and Europe. The Client is registered as a sole proprietor for the transportation of all types of cargo – from small to large-sized, has 6 sets of trucks (tractors) with trailers and carriages and rents 2 more sets. The company has 6 officially registered employees.

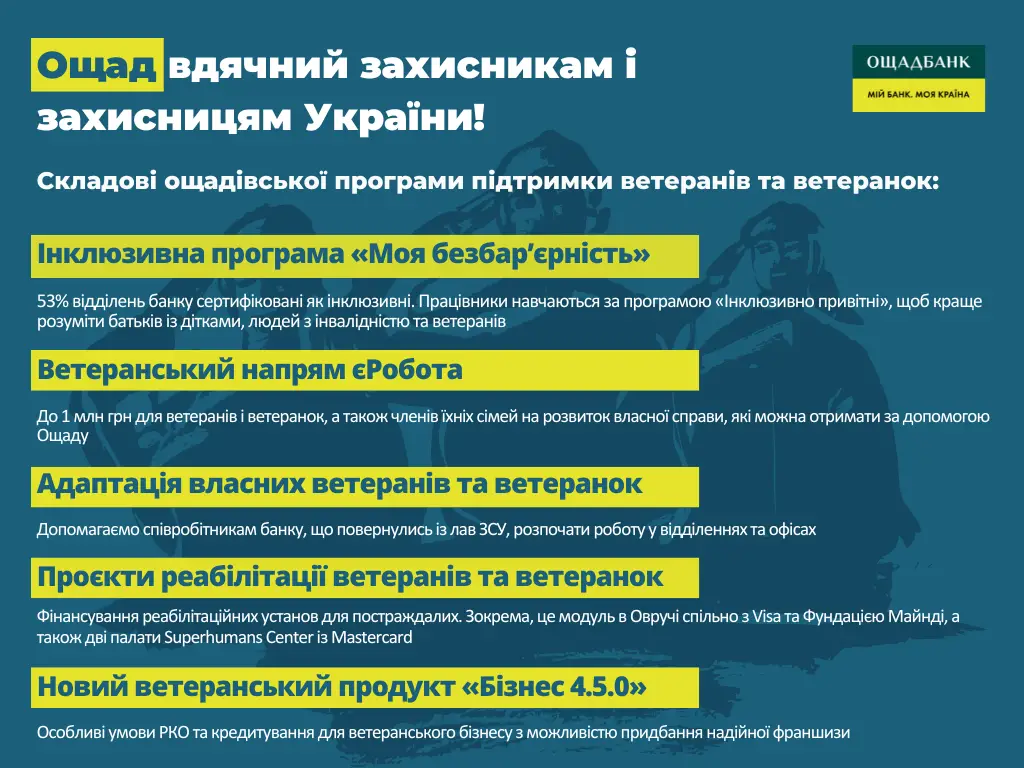

On April 15, Oschad was the first Ukrainian bank to launch a veteran program for micro, small and medium-sized businesses (MSMEs) called "Business 4.5.0". It can be used by a veteran or veteran (combatants), veteran's family (spouse, children, parents), as well as an enterprise where more than 30% of the staff are veterans / combatants.

The program contains the following components

Preferential lending for own business or existing veteran business on the following terms:

- the amount is up to UAH 5 million;

- term – up to 60 months;

- target use – purchase of fixed assets, repair of premises, replenishment of working capital;

- preferential rate under the program "Affordable Loans 5-7-9%": for investment needs – 5-9%, for working capital – 13% or 4-8% (under the WNISEF program).

Lending for the purchase of a franchise (possible for borrowers without entrepreneurial experience) on the following terms:

- maximum loan term is 120 months;

- equity – at least 30% of the project cost;

- the amount is up to UAH 5 million;

- collateral for the loan (fixed assets).

Preferential tariff package for bank account servicing:

- with no account maintenance fee up to 30 September 2024;

- preferential rate for money transfers.

Consultation and training:

- support at all stages of business development;

- personal manager consultations;

- training programs and workshops.

In total, within three weeks of the program launch, Oschadbank received applications for loans under this program totaling almost UAH 10 million – they came from representatives of veteran businesses from Ivano-Frankivsk, Odesa, Ternopil and Khmelnytskyi regions.

To learn more about the Business 4.5.0 product or to apply, please contact us here .

Press service of Oschadbank